All-in-One Insurance Coverage for Plumbing Professionals

Protect your contracting business from potential financial losses with specialized liability protection.

Understanding Plumbing Liability Insurance Coverage

Plumbing Insurance provides essential financial protection against claims from clients or third parties resulting from accidents, property damage, or injuries related to your plumbing work or employees’ actions. Even with strict safety standards, unexpected issues can arise, making this coverage crucial.

As a professional plumber, you prioritize safety and quality. However, accidents can still happen. Plumbing Insurance helps safeguard your business assets, reputation, and operations when the unexpected occurs.

In many states, carrying this type of coverage is mandatory to legally operate. Our company offers reliable and affordable Plumbing Insurance designed to protect your business without overwhelming costs—so you can focus on what you do best

Do you have a question? Call us 24/7

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service

What Does Plumbing Liability Insurance Cover?

Workers compensation insurance provides a safety net for employees injured on the job. Here’s a breakdown of what this coverage typically includes:

Medical Expenses:

Pays for medical treatment if an employee is injured on the job. Example: An employee slips, falls, and requires hospitalization and rehab.

Wage Replacement

Compensates employees for income lost during recovery. Example: An employee is unable to work for six weeks following surgery.

Disability Benefits

Provides financial support for permanent work-related disabilities. Example: An employee suffers lasting limb damage and receives long-term aid.

Vocational Rehabilitation

Helps injured workers return to the workforce through retraining. Example: A worker is retrained for a new position that fits their physical capabilities.

Death Benefits

Offers financial assistance to the family of an employee who dies due to a job-related accident.

Why Contractors Should Have Liability Insurance

Plumbing insurance is essential for shielding your business from unexpected accidents, costly lawsuits, and property damage claims.

It helps cover legal fees and compensation costs if a third party files a claim for injury or damage caused by your plumbing work. In many cases, having this insurance is a requirement for contracts, helping you secure more jobs and maintain trust with clients.

With proper coverage in place, you can focus on growing your plumbing business, knowing that unexpected liabilities are taken care of.

15 Good Reasons To Choose Us

Licensed Nationwide – We provide plumbing insurance coverage in all 50 states. Wherever your plumbing business is, we’ve got you covered.

Bilingual Support – Our friendly agents speak both English and Spanish fluently, ensuring clear communication at every step.

Trusted for Over 20 Years – Backed by two decades of experience, an A+ BBB rating, and thousands of 5-star reviews from satisfied clients.

Tailored Coverage Review – Our specialists will assess your plumbing operations to ensure accurate classification for General Liability and Workers’ Compensation insurance.

Focused on Plumbing & Contractor Coverage – We specialize in insurance for plumbers and contractors, including general liability, commercial auto, property, workers’ comp, and bonding.

Expert Guidance – Our experienced team will help you choose the right coverage to protect your plumbing business without paying for what you don’t need.

Affordable, Correct Coverage – We ensure your plumbing business is insured correctly at the most competitive price.

- Access to 18+ Insurance Carriers – We work with top national and regional providers that local agents often can’t access—giving you more options.

- Fast Quotes, No Delays – Get a quick and accurate plumbing insurance quote without being left waiting.

- We Handle the Paperwork – We’ll obtain your loss runs and claim history directly from your previous carrier for a smooth transition.

- Top-Tier Customer Service – Need a certificate of insurance? We guarantee delivery within 4 hours—every time.

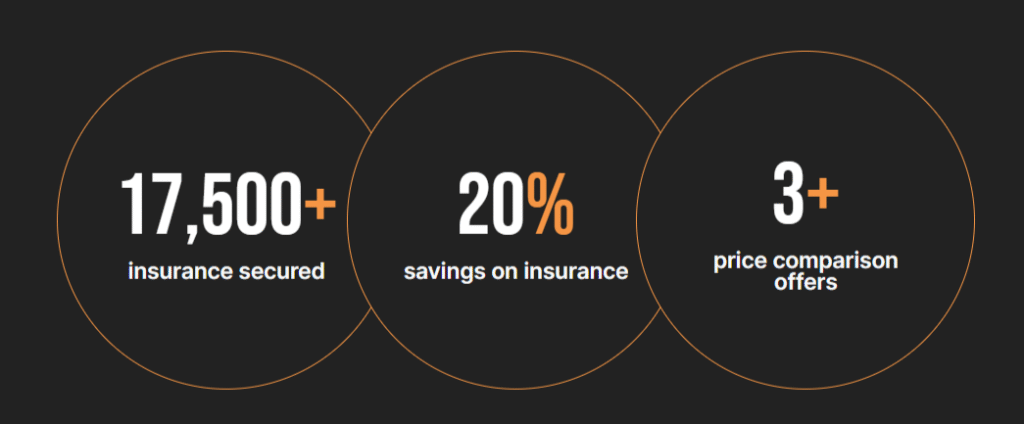

- Compare Multiple Quotes – We’ll present at least three quotes from top providers so you can choose the best fit for your business.

- Experience Mod Review – We’ll analyze your workers’ compensation experience mod to help you earn any discounts you deserve.

- Flexible Payment Options – Choose from a variety of payment and financing plans to suit your cash flow.

- Free, No-Obligation Quotes – Get a personalized quote for your plumbing business—no strings attached.

FAQ: What Isn’t Covered by General Liability Insurance?

No, injuries occurring outside of work hours or during personal activities are not covered.

No, injuries inflicted deliberately by an employee are excluded from coverage.

No, injuries sustained while committing illegal acts are not covered by workers compensation insurance.

Typically, no. General Liability policies usually do not cover punitive damages, which are fines imposed by the court to punish intentional misconduct.

Intentional acts, such as an employee purposely damaging a client’s property, are not covered by General Liability Insurance. These are excluded because they are not accidental.

GET FREE QUOTES WITHIN 3 MINUTES

Pick your State to get started! We’ll compare policies from leading providers and show you the best rate after

We’ll Save You Up To 20% On Any Policy

*All information given is treated very seriously by us and will never be shared. For more information about how we store and secure your data, please refer to our Privacy Policy.