General Liability Insurance

Essential Coverage for Your Business

Secure Your Plumbing Business with Tailored Insurance

Protect your plumbing business from unexpected liabilities with comprehensive general liability coverage. Whether you’re a solo plumber or managing a growing team, this policy safeguards you against third-party claims for property damage or bodily injury—such as accidental water damage in a customer’s home or slip‑and‑fall incidents on site

Our policies are custom-designed for the plumbing industry, addressing the unique risks you face—tools in transit, job‑site accidents, and aftermath cleanup—so you can confidently focus on your projects without fear of legal complications

What Is General Liability Insurance?

As a plumbing contractor, you diligently prioritize safety and quality, yet despite best efforts, unforeseen accidents like burst pipes, leaks, or slips on a damp surface can still occur. Plumbing general liability insurance is essential—covering customer injuries, property damage, repair costs, legal defenses, and settlements when your work inadvertently causes harm . This coverage not only preserves your business and personal assets, but is also often a legal requirement or a condition for licensure in many states It enhances client trust too—having proof of insurance demonstrates professionalism and reassures customers that they’re working with a reliable, protected contractor specializes in delivering affordable and dependable General Liability Insurance specifically for plumbers, ensuring you get the protection you need—without overpaying—so you can focus on your craft with confidence.

Get a Free General Liability Insurance Quote fast

Only 5 minutes of your valuable time. We can often get same day coverage.

What Does General Liability Insurance Cover?

Plumbing General Liability Insurance helps protect your business from third-party claims involving property damage, bodily injury, and related issues. One of the key advantages of this coverage is that it also includes legal defense costs—like attorney fees—if your business faces a lawsuit over a covered incident.

Bodily Injury

Covers claims if someone is hurt as a result of your work or equipment. Example: A person trips over your tools during a plumbing job and gets injured.

Reputational Harm

Offers protection against accusations like libel, slander, or unauthorized use of a client’s images. Example: Featuring a client's home in your marketing materials without their permission could result in legal action.

Medical Payments

Pays for medical costs if someone is injured at your business location. Example: A client slips and falls while visiting your office and requires medical attention

Property Damage

Covers accidental damage to a client’s or third party’s property. Example: A plumber accidentally breaks a customer’s window while carrying equipment inside.

Damage to Rented Premises

Provides coverage for damages to properties you rent, caused by specific incidents. Example: A fire starts in your rented shop due to a faulty gas line connected to your equipment.

Advertising Injury

Protects your business from claims related to advertising mistakes, such as copyright infringement. Example: Using another company’s slogan in your ad without permission results in a legal claim

Do you have a question? Call us 24/7

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service

Why do you need General Liability Insurance?

Plumbing General Liability Insurance is essential for protecting your business against expensive lawsuits and unexpected incidents. It helps cover legal costs and compensation if a third party claims property damage or bodily injury caused by your work, shielding you from major financial setbacks.

This type of insurance is often a requirement in contracts, making it vital for winning jobs and building trust with clients. With proper coverage in place, you can operate with confidence, knowing your business is protected and you’re free to focus on growth—not legal risks.

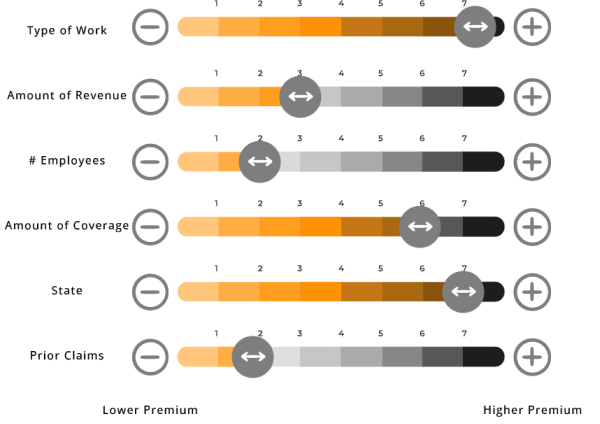

Common Factors That Affects Your General Liability Insurance Cost

There are common factors that insurance companies use to determine insurance costs. These are:

- The type of work being performed.

- The amount of revenue of the company.

- The number of employees.

- The amount of coverage requested.

- The State where the company is located.

- The prior claims history of your business.

FAQ:

No, injuries to your employees are not covered by General Liability Insurance. Employee injuries are handled through Workers’ Compensation Insurance. For example, if an employee falls from a ladder, General Liability won’t cover the medical costs or lost wages.

No, professional mistakes or errors in advice are not covered. For this, you’ll need Errors and Omissions Insurance (Professional Liability Insurance) to protect your business from claims related to advice, recommendations, or professional services.

No, General Liability Insurance does not cover vehicle-related incidents. You need Commercial Auto Insurance for protection in case of accidents involving business vehicles.

Typically, no. General Liability policies usually do not cover punitive damages, which are fines imposed by the court to punish intentional misconduct.

Intentional acts, such as an employee purposely damaging a client’s property, are not covered by General Liability Insurance. These are excluded because they are not accidental.