All-in-One Insurance Coverage for Plumbing Professionals

Protect your contracting business from potential financial losses with specialized liability protection.

Why Plumbers Require Insurance?

Plumbing work comes with a unique set of challenges—tight spaces, heavy tools, water systems, and unpredictable environments. Without proper insurance, a single mistake can lead to serious financial consequences. That’s why tailored insurance for plumbers is critical, whether you’re based in 92660, Victoria, or anywhere across the U.S.

Here’s how plumbing contractors insurance safeguards your operations:

- Injury Risks on the Job

- From handling sharp tools to working in crawl spaces, plumbing exposes workers to frequent hazards. Slips, falls, and equipment-related injuries are common. Workers comp insurance for plumbers ensures your team is protected—covering medical bills, lost wages, and rehabilitation if someone gets hurt on site.

- Property Damage Protection

- A burst pipe or a poorly fitted valve can cause expensive water damage in a home or office. General liability insurance covers these incidents, keeping you financially secure when accidents happen. For tools and equipment in transit or stored offsite, inland marine insurance for plumbers offers added protection.

- Legal Liability Coverage

- If a customer claims your work caused damage or injury, legal expenses can escalate fast. Professional liability insurance for plumbers—especially crucial in states like Texas—helps cover legal defense and settlements, ensuring your business reputation stays intact. If you’re handling insurance work for plumbers, this coverage is often required by property managers or insurers.

- Protection for Your Business Assets

- Your office, storage unit, or toolshed needs protection too. Commercial property insurance for plumbers covers your physical location and business contents in case of fire, theft, or natural disasters.

Do you have a question? Call us 24/7

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service

Coverage Options for Plumbers

As a plumber, having the right insurance is crucial to cover every facet of your trade. Below are the primary coverage options we offer for plumbers:

General Liability:

Since plumbing work occurs on clients’ properties, accidents can happen. General liability insurance safeguards your business from lawsuits in case of injury or property damage while you’re on the job. For instance, if a pipe bursts and causes flooding in a client’s home, this coverage will handle repair costs and legal expenses if necessary, preventing severe financial loss.

Workers’ Comp:

Plumbing can involve various hazards such as chemical exposure, falls, and tool injuries. Workers’ compensation insurance ensures that if an employee gets injured, their medical bills and lost wages are covered, protecting your business from potential lawsuits.

Equipment Coverage:

The tools and machinery essential for your plumbing work represent a significant investment. Equipment insurance protects against theft, loss, or damage, allowing you to quickly replace or repair essential tools to keep your operations running smoothly.

Commercial Auto:

Your business relies on vehicles for transporting tools, materials, and workers. Commercial auto insurance covers your business vehicles against accidents, theft, and other incidents, ensuring uninterrupted service to your clients.

Custom Solutions:

Each plumbing business is distinct, with its own set of risks and operations. We offer tailored insurance packages that meet your specific needs, whether you run a solo operation or a large plumbing company. We work with you to create a plan that provides the necessary coverage without excess costs.

Why Plumbers Should Have Liability Insurance

Plumbing insurance is essential for shielding your business from unexpected accidents, costly lawsuits, and property damage claims.

It helps cover legal fees and compensation costs if a third party files a claim for injury or damage caused by your plumbing work. In many cases, having this insurance is a requirement for contracts, helping you secure more jobs and maintain trust with clients.

With proper coverage in place, you can focus on growing your plumbing business, knowing that unexpected liabilities are taken care of.

What Types Of Insurance Do Plumber’s Need?

Plumber’s Commercial Auto Insurance

You need to have Plumber’s Commercial Auto Insurance to cover the vehicles used in your business. If you just have personal auto coverage your insurance may deny your claim, especially if your van is covered in your companies advertising.

Inland Marine Insurance for Plumbers:

Do not let the name fool you. Inland Marine Insurance for Plumber’s covers your tools and equipment from theft or loss. Just think how much it would cost to replace all your tools if they were stolen or destroyed.

Workers Compensation Insurance for Plumbers

If you have employees you are required by law to have workers Compensation Insurance for Plumbers. Failure to have this coverage can lead to administrative actions and large fines. Also if an employee is injured on the job you will have to pay the medical bills, attorney’s fees, lost wages, etc. from your own pocket.

Business Owners policy for Plumber’s (BOP)

If you operate out of a physical location this is an option. A Business owner policy (BOP) for Plumber’s and Plumbing Business bundle’s a general liability and property coverage together in one policy. It is generally cheaper than buying the same coverage separately.

Umbrella Insurance for Plumber’s

An Umbrella Insurance Policy for Plumber’s gives protection from catastrophic losses that exceed an underlying policy insurance limits. It is relatively inexpensive and protects you from claims that would more than likely wipe out any business financially.

Surety Bonds for Plumber’s

If your state requires a license in most cases there will also be a Plumber’s Surety Bond requirement. It is also often the case that when you are connecting to a City sewer or water system a bond will be required before a permit is issued. These bonds are generally cost about 1% of the amount of the bond requested. In some instances, there may be a credit check before they are issued.

FAQ:

No, injuries occurring outside of work hours or during personal activities are not covered.

No, injuries inflicted deliberately by an employee are excluded from coverage.

No, injuries sustained while committing illegal acts are not covered by workers compensation insurance.

Typically, no. General Liability policies usually do not cover punitive damages, which are fines imposed by the court to punish intentional misconduct.

Intentional acts, such as an employee purposely damaging a client’s property, are not covered by General Liability Insurance. These are excluded because they are not accidental.

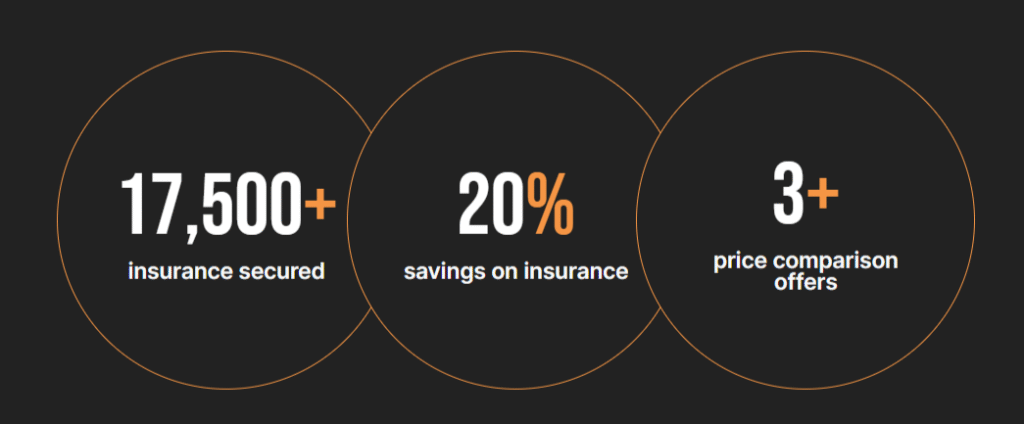

GET FREE QUOTES WITHIN 3 MINUTES

Pick your State to get started! We’ll compare policies from leading providers and show you the best rate after

We’ll Save You Up To 20% On Any Policy

*All information given is treated very seriously by us and will never be shared. For more information about how we store and secure your data, please refer to our Privacy Policy.